So the "function scenario" pnl would be the pnl stripped of cash desire effectiveness, and only displays the dangerous asset investment overall performance. I can realize why This can be the pnl Employed in my firm. Would you concur using this type of perspective? $endgroup$

I am specially keen on how the "cross-results"* between delta and gamma are taken care of and would love to see a straightforward numerical illustration if that's probable. Many thanks beforehand!

Ie: If we know the inventory is going to near near the opening rate as it normally performs over a 1 vol, and its midday as well as stock is down -10%, we realize that it should go greater in the last few hours on the working day and we could just outright invest in inventory to make money.

In expenditure banking, PnL explained (also known as P&L clarify, P&L attribution or financial gain and reduction discussed) is undoubtedly an income statement with commentary that characteristics or clarifies the day by day fluctuation in the worth of the portfolio of trades to the root causes on the adjustments.

On the other hand, the gamma PnL is paid for you around the facet, not on the choice top quality, but with the buying and selling activities inside the fundamental you carry out your hedging account.

$begingroup$ In Preset Revenue, I understand that bonds PnL are evaluated determined by where by the price lies on price tag/produce curve at the end of the day, compared to where by it began from at beginning from the pnl day.

Your browser isn’t supported anymore. Update it to get the greatest YouTube practical experience and our most current capabilities. Learn more

Al citar, reconoces el trabajo unique, evitas problemas de plagio y permites a tus lectores acceder a las fuentes originales para obtener más información o verificar datos. Asegúlevel siempre de dar crédito a los autores y de citar de forma adecuada.

So this quantity is utilized for earnings (income or decline) but in addition to observe traders as well as their limitations (an enormous hit in one group would imply anything is Erroneous).

Esto en realidad puede llevar a graves dificultades a la hora de elaborar un mensaje, ya que centrarnos en las reacciones o estar en alerta ante posibles consecuencias, no es algo que vaya aportar calidad a la comunicación.

InnocentRInnocentR 72211 gold badge66 silver badges1818 bronze badges $endgroup$ 1 $begingroup$ For those who were to delta hedge repeatedly and with a costless foundation, then your payoff at expiry would match that of a vanilla selection.

$ Now you say $V_t$ is the dangerous asset. Pretty perplexing. Edit the put up to help make this crystal distinct. We will contemplate what is a PnL when we determine what we have invested in. $endgroup$

And this is dependent upon the rebalancing frequency. But "anticipated P&L" refers to an average around all doable cost paths. So There exists not necessarily a contradiction in this article. $endgroup$

How Is that this correct while? Delta-hedging frequency incorporates a direct effect on your PnL, and not merely the smoothness of it.

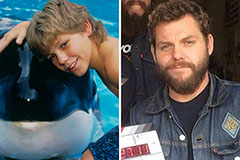

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!